Get your EFIN for your Tax Preparation Business

Filing tax returns electronically started in 1986. Since then, the IRS has significantly improved the systems for filing taxes.

In 1990, 4.2 million returns were done electronically nationwide. Over 25 years, the IRS has transmitted more than 1 billion tax returns.

What is an EFIN?

The IRS created the Electronic Filing Identification Number (EFIN). Tax preparers can become an authorized IRS e-file provider through an application and screening process. In 2012, the IRS made this as a requirement for tax preparers who prepares and files 11 or more tax forms during a calendar year.

Getting an EFIN would enable you to efficiently file tax returns for your clients with lesser processing time. The e-file system also processes your clients’ refunds faster. Overall, the e-file system increases your productivity and improves your client service.

Do I need an EFIN to prepare taxes?

Not all tax preparers need an EFIN, unlike the Preparer Tax Identification Number (PTIN). If you are employed as a tax preparer for a firm, your firm most likely has an EFIN assigned to it already.

However, if you are a tax preparer building your own business, you must secure an EFIN for your practice. The Principal and Responsible Official from your practice should sign up for the EFIN.

The IRS has been campaigning to move all tax returns filing via the eFile system. All tax preparation business must be equipped with an EFIN since the IRS requires any businesses that files more than 10 tax returns to use their eFile Services. Even before you could purchase any tax preparation software, an EFIN is a requirement.

Who are the Principals and Responsible Officials

Setting up your firm’s EFIN is essential. However, not everyone in the company needs to apply for it. Only Principals and Responsible Officials need to fill in the application.

Principals who need to apply for an EFIN:

- Sole Proprietor – individual entrepreneur

- Partners – a partner who has five percent or more interest in the company

- Corporate Officers – President, Vice President, Secretary, and Treasurer

- Key Persons – if a sole proprietor, partner, or corporate officer is not involved in the filing of tax returns of the company, the professional who does should apply for the EFIN instead.

Aside from the Principal, a Responsible Official also needs to apply (if applicable). The Responsible Official is the individual with authority over the IRS e-file operation. He or she is the first point of contact with the IRS.

For new tax preparers building their practice, you are the Principal and the Responsible Official for your company.

If in the future you would like to add more Principals or Responsible Officials to your EFIN, you can add or change it via an IRS e-file application.

Principal and Responsible Official Eligibility

To be an eligible Principal or Responsible Official, you must be:

- A United States Citizen or a Foreigner with Permanent Residence Status

- At least 18 years of age as of the date of application

- Meet applicable state and local licensing and/or bonding requirements for the business of preparation and collection of tax returns

Requirements Needed for Your EFIN Application

Having an EFIN and an e-services account means having access to systems of the IRS. So, the IRS takes the time to investigate a tax preparation firm and the employees that will use the system thoroughly.

Before a tax preparer can create an IRS e-services account, the following documents must be ready:

- Most up-to-date email address

- Social Security Number

- Tax filing status

- Last-filed Tax Return

- Mobile Device Number

- Personal account number

- Credit Card

- Home Mortgage Loan

- Home Equity Loan (second mortgage)

- Home Equity Line of Credit (HELOC)

- Car Loan

Each tax preparer that sets up an e-services account must register to a two-factor authentication process. A U.S. based mobile number is essential for this process.

The IRS will not store the personal account data on their file. However, the IRS will verify your identity through this data.

How to Apply for an EFIN

Applying for an EFIN is done via the IRS e-services webpage.

Steps to apply for an EFIN:

- Go to the IRS e-services page

- Create an account

- Apply for an EFIN

- Select an e-file Provider Options (i.e. Electronic Return Originator, Transmitter)

- Each Principals and Responsible Officials need to submit a fingerprint card

- Each professional must answer personal questions

- Home Equity Line of Credit (HELOC)

- Each professional must sign a Terms of Agreement and declare under penalty of perjury that the personal information is true

- Pass the Suitability Test

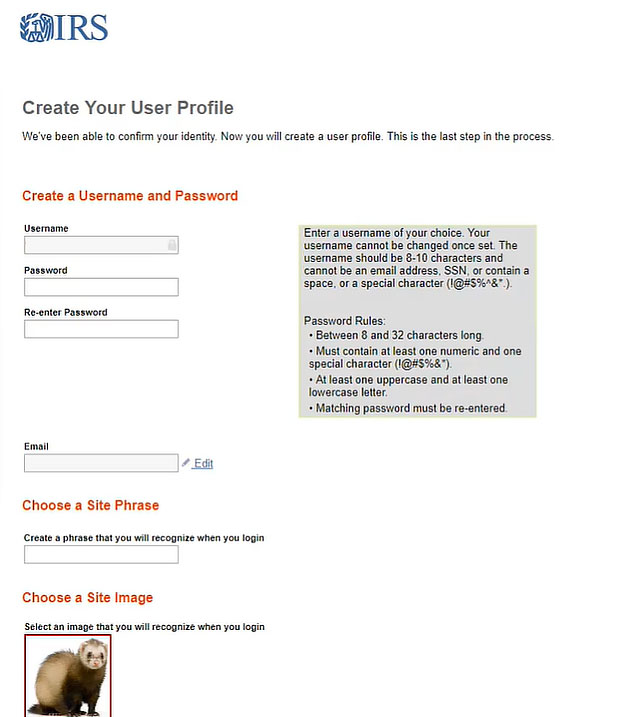

Screenshot from the IRS website | Create Your User Profile

The application is comprehensive and may take time. At any time, you can save your progress and then come back to it.

Aside from answering and submitting documents online, the Principal and Responsible Officials must accomplish a fingerprint card. Within 48 hours, call the IRS toll free at 866-255-0654 to request for fingerprint cards.

You can get a trained professional to accomplish the fingerprinting process. You can get this at the local police or sheriff station or a company that provides a fingerprinting service.

After submitting all the documents, the IRS will conduct a suitability check on all the listed applicants. A suitability check would be in the form of criminal background check, credit history checks, tax compliance, and non-compliance of IRS e-file requirements.

Provider Options Testing

Applicants must choose one Provider Option. The IRS has a list of authorized IRS e-file providers that is close to your location.

During the application period, the Providers’ Software Developers and Transmitters must conduct testing of the programs. It’s important that the testing is done within the 45-day turnaround time of the application process.

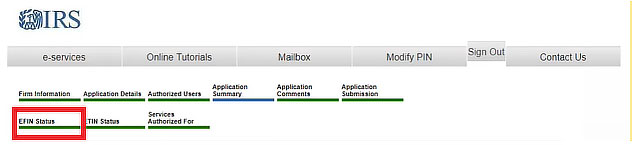

Check EFIN Approval in Your IRS e-Services Account

The IRS approves your e-file application after all the Principals and Responsible Officials pass the suitability test. You can check your EFIN’s status on the main menu of the e-services account.

Steps to check your application:

- Login to your e-services account

- Select the organization you are checking for.

- Some account may have multiple EFINs from different businesses

- Once you’ve selected your organization, this will lead you to the homepage which shows your Application.

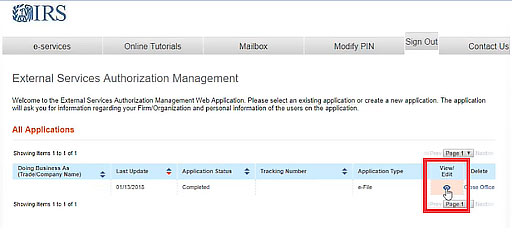

Click on View/Edit under the applications you’ve submitted.

Screenshot from the IRS website | External Services Authorization Management

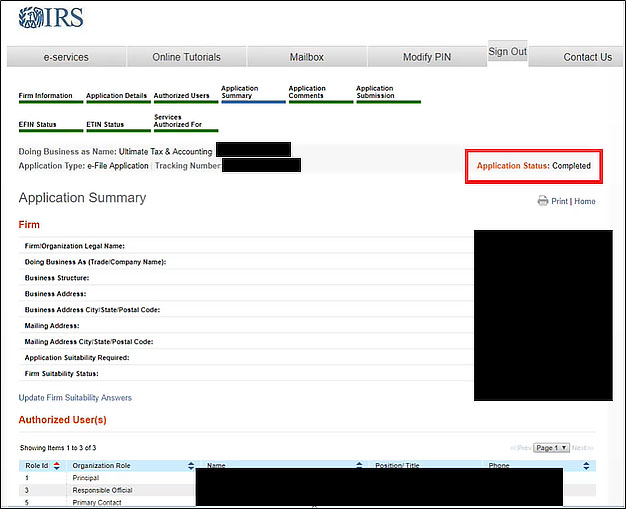

- Then, you will be directed to the Application Summary page.

On the right corner (just above the Application Summary Title), you will see your Application Status.- If you cannot see this page, just click on the Application Summary button on the Toolbar above.

Screenshot from the IRS website | Application Summary

- Click on the EFIN Status button on the toolbar to check your EFIN status.

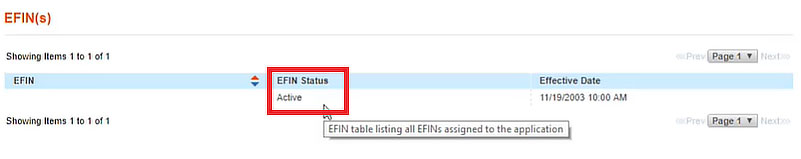

It will direct you to the EFIN Status part of the webpage.

Screenshot from the IRS website | Main Menu

Screenshot from the IRS website | EFIN(s) Page

Renew your EFIN

Do EFINs need renewal? Good news is no, you do not need to renew. Once your office is approved as an e-File Provider, there’s no need to renew or reapply your EFIN as long as you continue filing tax returns using the eFile system every year.

If an office does not file tax returns electronically in two consecutive years, the IRS will send a notification of removal from the list of active Authorized e-File Provider. Once you receive the message, you have sixty (60) days to respond and reactivate your EFIN. Should you fail to respond within the time allocated, you will need to resubmit a new application.

In the event that the IRS suspends an e-File Provider, you may apply for reactivation of your EFIN after the suspension has been lifted. However, if the IRS expels your EFIN, you may no longer reapply.

All changes in your EFIN should be applied using the IRS e-Services account.

Reasons for not Filing Electronically

Having an EFIN does not mean that you have to file all tax returns electronically. If a client prefers paper filing, the tax preparer can do so. A client must then sign a document that verifies that it was his choice to file tax returns manually. Tax preparers and clients must fill in Form 8948, and submit it along with the other tax returns documents.

A tax preparer could also waive filing tax returns electronically if there is a difficulty.

Some valid reasons for not filing electronically:

- Bankruptcy

- Economic Reasons

- Presidential Disaster Area

Tax preparers must file for an e-file Hardship Waiver Request from October 1 of the previous year to February 15 of the current year.

Example: If you are filing a waiver for tax return filing for the year 2020, the waiver must be submitted from October 1, 2019, to February 15, 2020.

Steps for filing for an e-file Hardship Waiver Request:

- Download and print Form 8944

- Fill in Details

- Enter the calendar year that this waiver is for in Line 1

- Explain your reason in Line 9

- Mail the form to:

Internal Revenue Service

310 Lowell Street Stop

983 Andover, MA 01810

The waiver request is subject to approval from the IRS. It will take four to six weeks for the IRS to process your request.

Once approved, you will be given an approval letter that indicates your waiver reference number. You must include this waiver reference number and approval letter date every tax return you file for the year.

If denied, you must file a completed Form 8948 for every paper tax return you file.

Frequently Asked Questions

How long does it take to get an EFIN?

It takes the IRS about 45 days to process the EFIN application and complete the suitability checks. In extreme cases, it can take up to 12 weeks. Start applying for your EFIN around October of the previous year so you can start preparing taxes for the next calendar year.

How much does an EFIN cost?

Is an EFIN transferable?

An EFIN is unique to each tax preparation businesses. The IRS does not encourage the transfer of EFINs. It is highly important to keep your EFIN secured. If your EFIN is compromised, report it to the IRS.

What are some examples of invalid use of an EFIN?

- using an EFIN that is not associated with your firm

- using one that a previous employer-owned

- using one from a firm that has changed its structure making it different from the application

Should the IRS become suspicious of invalid use of any EFIN, the IRS will conduct a thorough investigation. The IRS will determine if further action is required after reviewing the situation. Further action includes a fraud referral.

Who do I contact if I have a question about my EFIN?

For additional help, you can contact the IRS EFIN Phone Number for Tax Professionals – 866-255-0654 (6:30 AM to 6 PM CT) or visit the IRS.gov website located HERE.

Where can I get information about the EFIN?

- Publication 3112 – EFIN Application

- Publication 1345 – Handbook for active IRS eFile Providers

- Circular 230 – Regulations related to IRS practices