Get your PTIN to Be

a Tax Preparer

Professional tax preparers need to register with the IRS first. A tax preparer must get the Preparer Tax Identification Number or PTIN. All tax preparers use this ID number on all of their clients’ filed tax returns.

The PTIN was created in 1999 to ensure the privacy of tax preparers. Before the PTIN, tax preparers used their own Social Security Number (SSN) on every prepared tax return. Clients then have access to a tax preparer’s SSN, which opens the tax preparer up for possible identity theft.

Each tax preparer must file for their PTIN at the beginning of their professional career. The ID number is unique to you, and cannot be used by others. Whether you are building your own tax preparation business or you are looking to be employed, you need to have a PTIN.

The IRS issues PTINs per calendar year. Each PTIN expires on the last day of the year. Applying for the upcoming year starts as early as mid-October of the current year.

Example:

For 2019 tax returns, a tax preparer must apply for a 2019 PTIN from October 2018 until December 2019.

Take note, registration, and renewal of PTINs are free. Applying for a PTIN is quick and easy. There are two ways: via the online application and via mail.

PTIN vs. EFIN

A tax preparer’s PTIN is not the same as his Electronic Filing Identification Number (EFIN). Both are needed to start a tax preparation business, but are used for different purposes. As a tax preparer, you need a PTIN to start working for a fee.

EFINs are used to identify an authorized e-File Provider. Not all tax preparers need one; however, all tax preparation businesses do. Therefore, a PTIN is issued to an individual and an EFIN is issued to a business.

Requirements Checklist

Before applying for your PTIN, here’s a checklist of what you need to prepare:

- Social Security Number

- Personal information (name, mailing address, date of birth)

- Business information (name, mailing address, telephone number)

- Individual Tax Return

- Supporting ID and documents

- If applicable, U.S.-based professional certification information including certification number, where it was issued, and expiration date

Additionally, you would need to prepare the following if it’s applicable:

- Explanation for felony convictions

- Explanations for problems with your U.S. individual or business tax obligations

The PTIN requires a tax preparer to authenticate your identity. Providing your SSN and valid IDs is required.

List of Acceptable Supporting Documents:

- Passport/Passport Card

- Driver’s License

- U.S. State ID Card

- Military ID Card

- National ID Card

For additional documents, do not submit original copies. Instead, send certified or notarized copies.

Individual tax returns will help the IRS to verify your details through their records. The previous year’s tax return would suffice. However, if you filed your tax return within eight weeks before obtaining a PTIN, use the tax return for the year before last. You will need to continue to file your tax return so that you can continue to renew your PTIN number once received.

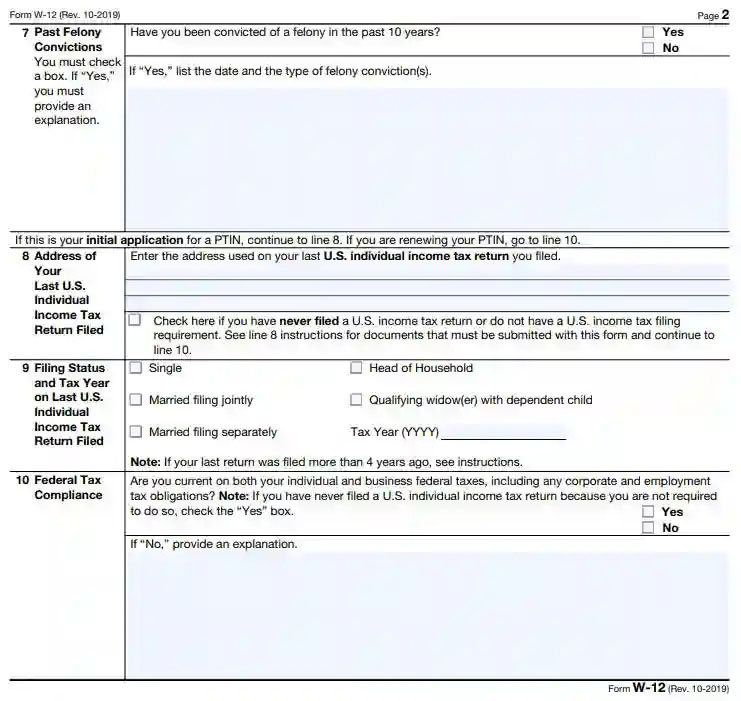

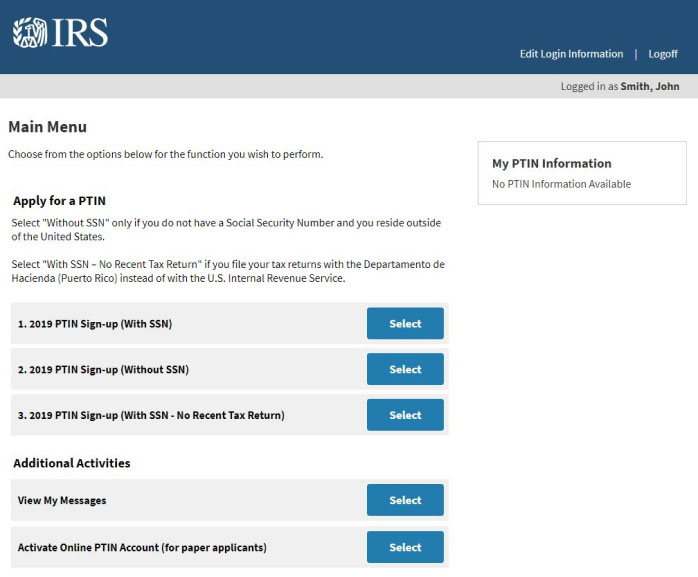

Indicate in your PTIN application if you do not have any filed Tax Returns. In the online application, choose the PTIN Sign-up (No Recent Tax Return) option and follow the website’s prompts. If you choose to file manually using the form W-12, make sure to check the box for “Check here if you have never filed a U.S. income tax return or do not have a U.S. income tax filing requirement.” in Line 8.

Screenshot of W-12 form from IRS website.

Tax preparers are not required to have licenses. However, for professionals who have licenses, details must be provided. For anyone who has a state license, you must also include this in your application.

Professions with licenses:

- Certified Public Accountant (CPA)

- Lawyer

- Enrolled agent

- Enrolled retirement plan agent

- Enrolled actuary

- Certified acceptance agent

Tax preparers, who have felony convictions or discrepancies with federal tax obligations, may not be eligible for a PTIN depending on IRS ruling.

Apply Online

The fastest way to get a PTIN is by applying online. After applying, a tax preparer can obtain his PTIN after 15 minutes.

Steps to applying online:

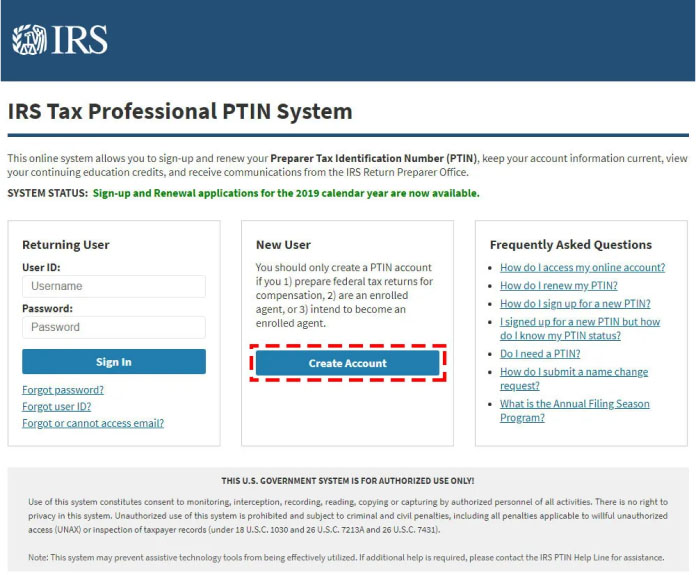

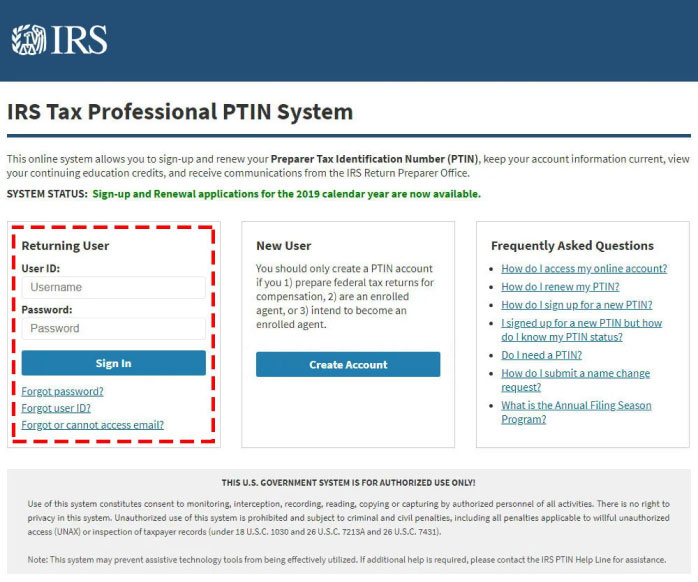

- Go to the IRS Tax Professional PTIN System

- Create a new account by clicking on “Create Account”.

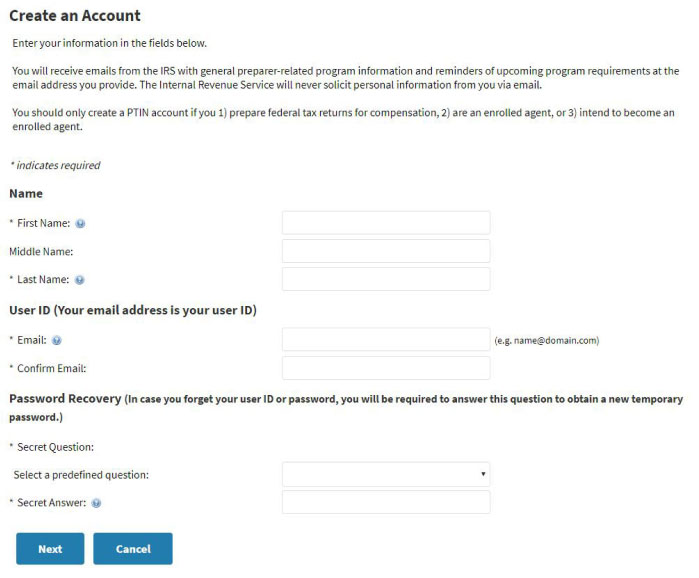

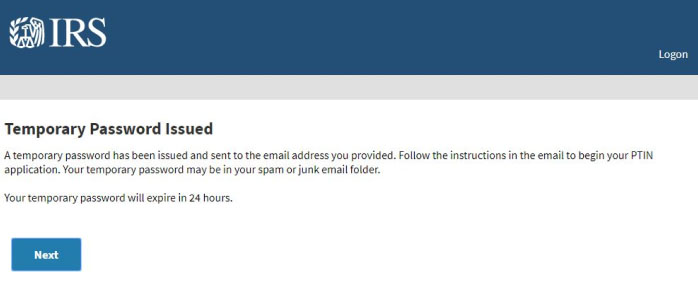

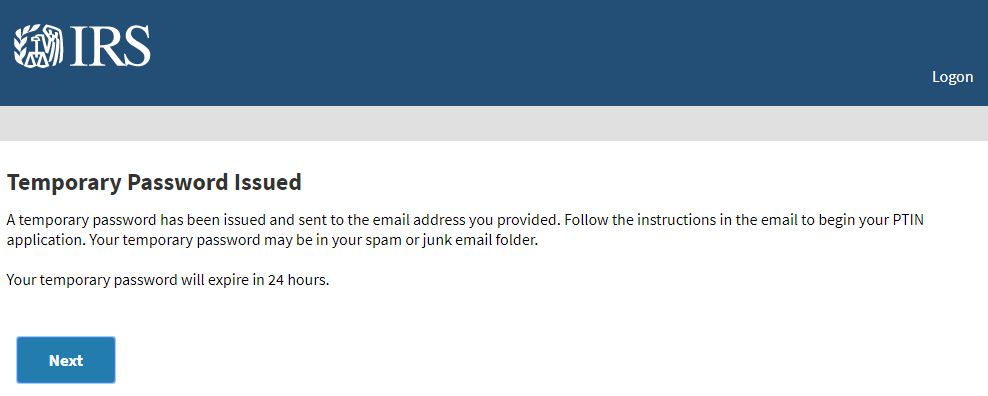

Screenshot from IRS website. - Setup your account and get a temporary password.

- Login to your account using your User ID and temporary password.

(Note: Your User ID is the email address you registered in the account setup.)

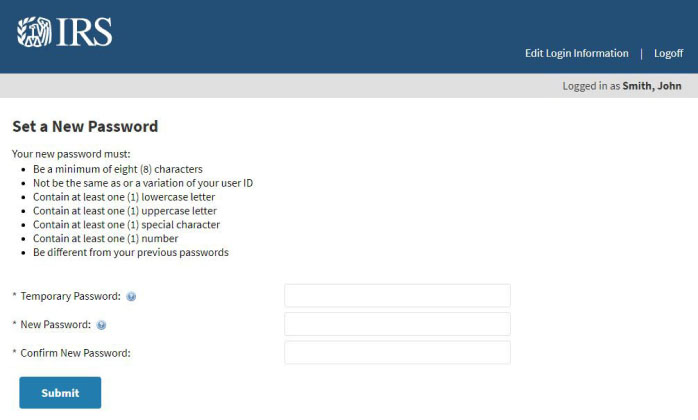

- Change your temporary password. (The website will prompt you in your first login.)

- Once logged in, follow the website’s prompts to apply for your PTIN.

(You will also be prompted to upload documents.)

- Once done, you can check your PTIN status on the information window at the top right of the Main Menu.

(Click on “Show Details”)

All correspondence related to your PTIN will be direct to the email address that you registered.

Apply By Mail

Another way to apply for a PTIN is by mailing an accomplished W-12 form to the IRS Tax Professional PTIN Processing Center. The manual process takes four to six weeks to accomplish.

Why would you apply by mail? If you are a tax preparer that does not have an SSN, you must apply for your PTIN by mail. Additional documents are needed for you to get your PTIN. In 2010, the IRS released the Revenue Procedure 2010-41 to accommodate tax preparers without SSN.

If you are a:

a. ) Tax Preparer that does not have SSN due to Conscientious Religious Objection

b. ) Tax Preparer who is not a U.S. citizen (and could not apply for an SSN)

Steps to applying by mail:

- Download and print a W-12 form

- Fill in your details on the forms.

- Mail the W-12 form and other documents to:

IRS Tax Professional PTIN Processing Center

1605 George Dieter PMB 678

El Paso, TX 79936 - Make sure to follow the detailed instructions when filling in the forms.

For tax preparers who is a Conscientious Religious Objector, an Authorized Representative of your Religious Group needs to complete a section of your Form 8945.

If original copies are required as part of your supporting documents, the IRS will return them via the mailing address that you provided.

Any application that does not have the complete supporting documents will not be processed.

Renew your PTIN

Once you get a PTIN, tax preparers would renew their it for the upcoming year. It’s best to renew your PTIN as early as October to avoid rushing for the next calendar year tax filing.

Similar to the application process, tax preparers can renew their PTIN via an online application, and via mail.

Renewal Checklist

- Personal information (name, mailing address, date of birth)

- Business information (name, mailing address, telephone number)

- If applicable, U.S.-based professional certification information including certification number, where it was issued, and expiration date

- Explanations for felony convictions

- Explanations for problems with your U.S. individual or business tax obligations

Renew Online

Renewing your PTIN online is easier than when you were applying for one. As long as your requirements are ready, it will take less than 15 minutes.

Steps to Renew PTIN:

- Login to your PTIN account. Enter your User ID and Password under the Returning User section.

Screenshot from IRS website. - Go to the Main Menu and choose PTIN Renewal. Click on Select.

- Follow the prompts on the website.

- Once completed, a confirmation of your PTIN renewal will be sent.

If you applied your PTIN by mail, you might not have a PTIN account yet. There’s no need for you to renew via mail. Instead, you can create an account and link your PTIN.

Steps to Link PTIN to a new account:

- Go to the IRS Tax Professional PTIN System

- Create a new account by clicking on “Create Account.”

Screenshot from IRS website - Login to your account using your User ID and temporary password. (Note: Your User ID is the email address you registered in the account setup.)

- Change your temporary password. (The website will prompt you in your first login.)

- Once logged in, choose to indicate your PTIN when prompted.

- Once your PTIN is linked, you can renew it by following the process above.

Renew by Mail

Similar to the application process, renewal by mail will take about four to six weeks for the IRS to accomplish it.

Steps to renewing by mail:

- Download and print a W-12 form.

- Fill in your details on the form.

- Mail the W-12 form to:

IRS Tax Professional PTIN Processing Center

1605 George Dieter PMB 678

El Paso, TX 79936

For tax preparers without SSN, there’s no need to accomplish Form 8945 and 8946 when renewing PTIN. However, it is important to indicate your date of birth on the form.

Importance of PTIN

All individuals that prepare and assist in taxes for profit must have a registered PTIN. Tax Preparers need to indicate their PTIN when signing their client’s tax returns.

If you do not add a valid PTIN on your client’s returns is a violation of the Internal Revenue Code section 6695. Tax preparers who violate this code may be penalized, may receive an injunction, and/or receive disciplinary action by the IRS Office of Professional Responsibility.

For a better understanding of individuals who needs a PTIN, you may refer to IRS’ PTIN scenarios.