Tax preparation is a critical aspect of managing one’s finances and ensuring compliance with tax laws. Taxpayers often find themselves facing a dilemma: should they tackle their taxes themselves or hire a professional tax preparer?

In this article, we will explore the pros and cons of professional tax preparation, helping individuals make informed decisions based on their specific needs and circumstances.

What is Professional Tax Preparation?

Professional tax preparation refers to the services provided by individuals or firms specializing in tax law and regulations. These professionals assist taxpayers in accurately and efficiently preparing their tax returns, ensuring compliance with applicable tax codes.

Tax preparers, tax advisors, and Certified Public Accountants (CPAs) are common professionals who offer tax preparation services. Tax preparers typically have training in tax preparation and focus on accurately completing tax forms based on the information provided by the taxpayer.

Tax advisors provide a broader range of tax-related advice and guidance beyond just preparing the returns. CPAs are accountants who have passed a comprehensive licensing examination and can offer a wide range of accounting and tax services.

The Advantages of Professional Tax Preparation

Professional tax preparation offers several advantages that individuals should consider when deciding whether to hire a professional.

Expert Knowledge and Experience

One of the primary benefits of hiring a professional tax preparer is their extensive knowledge and understanding of tax laws.

These professionals stay up to date with the ever-changing tax code, ensuring that taxpayers take advantage of available deductions, credits, and incentives. They have the expertise to navigate complex tax scenarios, potentially saving taxpayers money and helping them avoid common pitfalls.

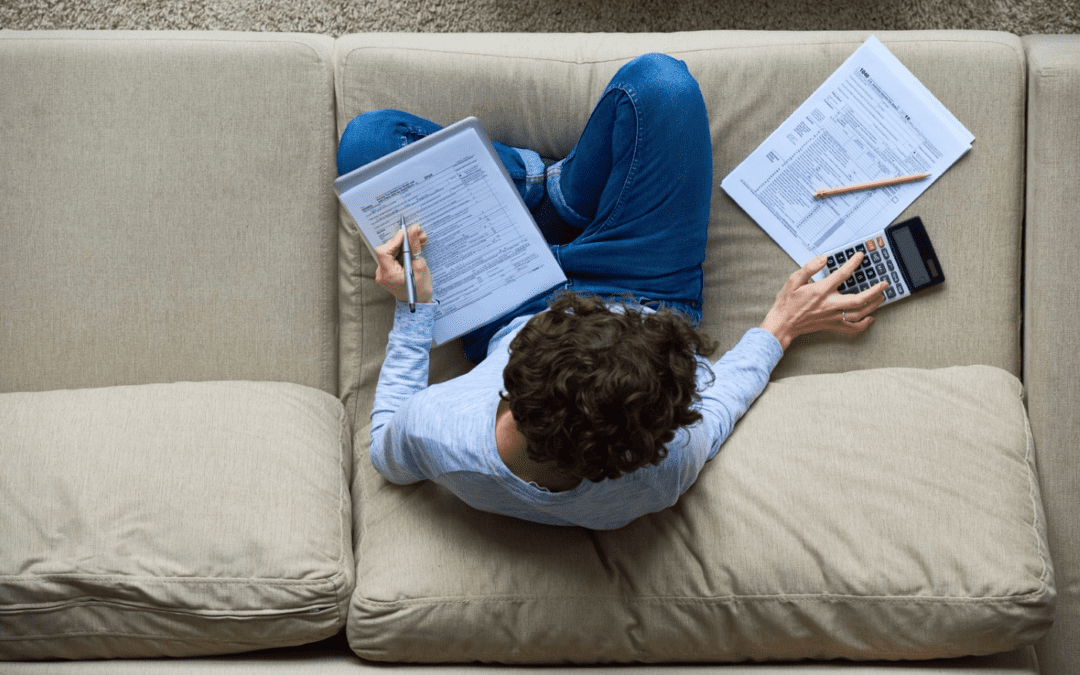

Time and Effort Saving

Preparing taxes can be a time-consuming and complex process, especially for individuals with multiple income sources, investments, or self-employment income. Hiring a professional tax preparer allows individuals to offload this responsibility, saving them time and effort.

Tax professionals have the necessary tools and resources to efficiently gather and organize the required information, complete the forms accurately, and submit the returns on time. This enables taxpayers to focus on other important aspects of their lives or businesses.

Professional Assistance in Case of Audit

While tax audits are relatively rare, they can cause significant stress and anxiety for individuals. Professional tax preparers provide valuable assistance in the event of an audit.

They can represent taxpayers, respond to IRS inquiries, and guide them through the audit process. Having a professional tax preparer by your side can provide peace of mind and ensure that you navigate the audit effectively.

The Disadvantages of Professional Tax Preparation

Alongside the advantages, it’s essential to consider the potential drawbacks of professional tax preparation. While professional tax preparation can offer convenience and expertise, it can also come with potential drawbacks such as high fees and the possibility of errors or omissions made by the tax preparer.

It’s important to weigh these factors before deciding whether to go the professional tax preparation route.

Cost

One of the primary disadvantages of hiring a professional tax preparer is the associated cost. Professional tax preparation services can be expensive, especially for individuals with complex tax situations.

The fees charged by tax preparers vary based on factors such as the complexity of the return, the geographic location, and the specific services provided. It’s important to weigh the potential benefits against the cost to determine whether hiring a professional is financially viable.

Risk of Incompetence or Fraud

There is a risk of hiring an incompetent or fraudulent tax preparer, which can have serious consequences. Incompetent tax preparers may make errors or omissions on tax returns, leading to penalties or audits.

Fraudulent tax preparers may engage in illegal activities such as claiming false deductions or credits to inflate refunds. To mitigate this risk, individuals should thoroughly research and verify a tax preparer’s credentials before entrusting them with their tax preparation.

Less Personal Understanding of Your Finances

By opting for professional tax preparation, individuals may take advantage of the opportunity to develop a deeper understanding of their personal finances. When individuals prepare their own taxes, they gain insights into their income, expenses, and deductions.

This process can provide valuable information for financial planning and decision-making. Outsourcing tax preparation entirely may limit the learning opportunities associated with personal financial management.

Factors to Consider When Deciding on Professional Tax Preparation

When deciding whether to hire a professional tax preparer or prepare taxes independently, several factors should be considered. The complexity of one’s financial situation is a crucial consideration.

If an individual’s finances involve multiple income sources, investments, or self-employment income, professional tax preparation may be beneficial to ensure accuracy and maximize deductions.

The cost-benefit analysis is another factor to evaluate. Individuals should weigh the potential tax savings, time saved, and reduced stress against the cost of hiring a professional tax preparer. The time available for self-preparation is also an important consideration.

Taxpayers with busy schedules or complex financial situations may need help to allocate sufficient time and effort to prepare their taxes accurately. In such cases, hiring a professional can provide peace of mind and ensure the timely submission of returns.

How to Choose a Professional Tax Preparer

It’s important to verify if the tax preparer has a valid Preparer Tax Identification Number (PTIN) issued by the Internal Revenue Service (IRS), as well as checking for any professional certifications or affiliations.

It’s also wise to ask for references or indicate how long they have been in business to ensure their credibility and expertise.

Here are some steps to consider:

- Check Credentials: Verify the qualifications and credentials of the tax preparer. Look for Enrolled Agent (EA) or Certified Public Accountant (CPA) certifications. These designations indicate that the tax preparer has met specific educational and ethical requirements.

- Compare Fees: Request fee quotes from multiple tax preparers and compare them. Remember that the cost may vary based on the complexity of your tax situation.

- Ask for References: Seek recommendations from friends, family, or colleagues who have had positive experiences with tax preparers. Alternatively, ask the tax preparer for references from previous clients and follow up with them to gauge their satisfaction level.

Taking Control: DIY Tax Preparation Software

For individuals who prefer a do-it-yourself approach, tax preparation software offers an alternative to hiring a professional tax preparer.

Popular tax software options such as UltimateTax, TurboTax, H&R Block, and TaxAct provide user-friendly interfaces, step-by-step guidance, and calculations to help individuals prepare their taxes accurately.

These software options often offer different versions tailored to different tax situations, including self-employment income or investments.

Your Tax, Your Choice: Making an Informed Decision

The decision of whether to opt for professional tax preparation or handle taxes independently requires careful consideration. Professional tax preparation offers expert knowledge, time-saving benefits, and professional assistance in case of an audit.

However, it comes with associated costs and the potential risk of incompetence or fraud. Factors such as the complexity of one’s financial situation, the cost-benefit analysis, and the time available for self-preparation should be evaluated.

Ultimately, individuals have the choice to take control of their taxes by utilizing professional services or leveraging DIY tax preparation software. Seeking the help of UltimateTax provides comprehensive tax software and support, ensuring a seamless tax preparation experience. Take charge of your tax preparation by visiting our website and exploring our offerings today.