How do I get an IP PIN from the IRS?

In today’s increasingly digital world, protecting personal information is of utmost importance, especially regarding financial and tax-related matters. The Internal Revenue Service (IRS) has implemented an effective tool known as an Identity Protection Personal...

What Do You Need to Be a Tax Preparer? Essential Qualities and Top Traits

In today’s ever-changing economic landscape, taxes are becoming increasingly complex and challenging to navigate. As individuals and businesses struggle to decipher the intricate tax codes and regulations, the demand for tax preparers has surged. To succeed as a...

Best Tax Software for Accountants in 2023

As we usher in yet another tax season, tax software has become an indispensable tool for accountants in facilitating efficient and accurate tax preparations. In today’s fast-paced world, where clients demand quick and reliable financial solutions, a good tax...

Here’s How to Opt-Out of the Child Tax Credit Payments

As part of the recently signed American Rescue Plan, major changes were made to the Child Tax Credit (CTC). For the 2021 tax year, families will have the option to receive advance payments of up to $300 per child, per month, starting in July. These payments could...

How to Become a Tax Preparer in Texas in 4 Easy Steps

Are you looking to jumpstart a career in the finance industry, particularly in the field of taxation? With the growing demand for skilled tax professionals in Texas, pursuing a career as a tax preparer could be a lucrative choice for you. This career option could be...

What Is My EFIN Number and Application Summary?

As a tax professional, it’s important to clearly understand your Electronic Filing Identification Number (EFIN) and application summary. Your EFIN is a unique number that identifies your business as an authorized e-file provider with the IRS. It’s...

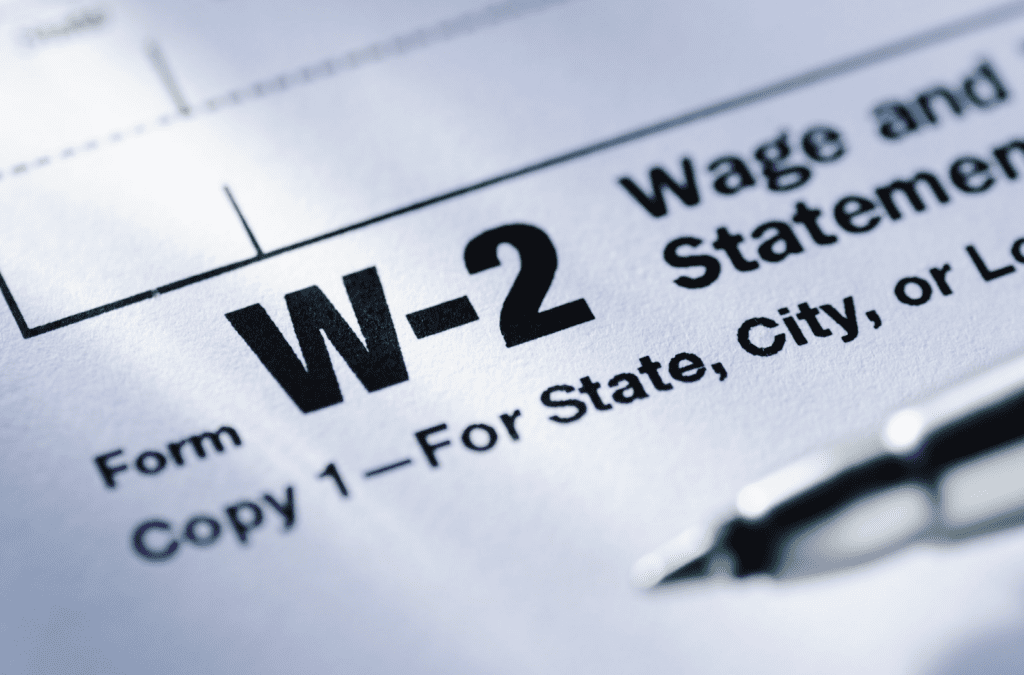

Getting a Copy of Your W2: What to Do If You’ve Lost It

The W2 form is a crucial piece of paperwork necessary for accurately filing taxes. It contains important information about an individual’s yearly wages and taxes withheld by their employer. Unfortunately, losing this document can cause a lot of problems during...

Tips for Choosing the Right Professional Tax Software

Anyone who pays taxes knows they’re complicated. And with the ever-widening tax brackets, numerous deductions, and other nuances, it can be challenging to figure out how much money you’ll owe and then how to pay it. That’s why so many people turn to tax software...