December 6, 2022

UltimateTax service has issued software to all customers who have already purchased for the 2023 season. This season we have seen many tax offices who are ready to get their office setup. Even though there have not been many changes to the desktop tax software, getting set up and ready for the season has advantages.

Advantages of setting up software early

As a tax office that has to install its software, being ready for the start of the season allows you to focus on growth and clients. All desktop software has to be installed. Ensuring your computers are up to date and have a firewall, virus protection, and security software is just as crucial as having current tax software. The IRS has guidelines for protecting the professional and client. Publication 5293

Whether it is UltimateTax or any desktop software, the tax software will have to have updates. Some changes and issues must be addressed each season and require the software to be updated. All professional tax programs have to have updates. Some states do not publish until later in the filing season. In 2022 North Carolina didn’t turn on e-filing till later in February.

Our tax software for tax preparers is a professional program used by thousands of preparers each year.

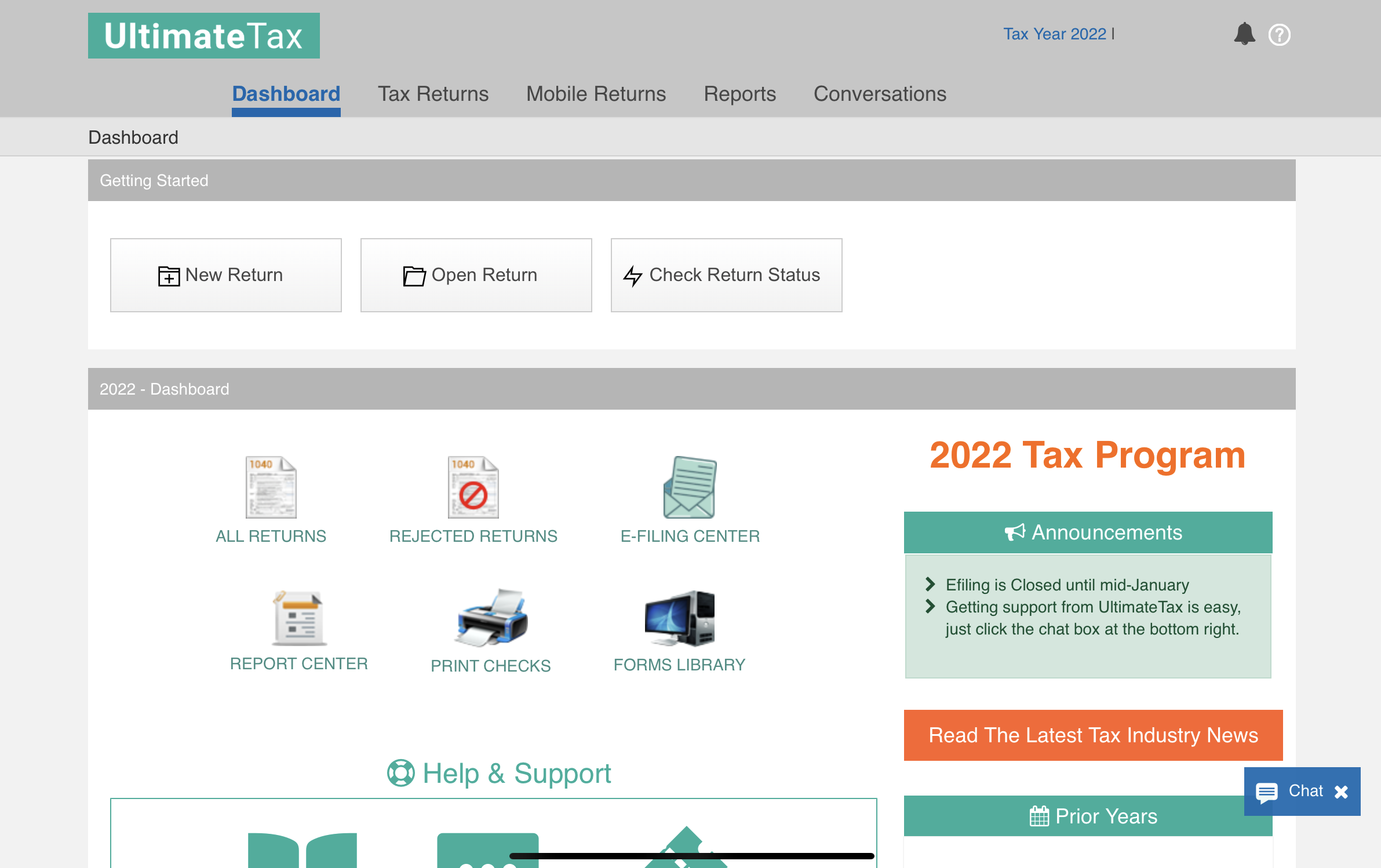

Online Version is ready for use.

The online version of UltimateTax Professional tax software is released and ready for use. There have been many enhancements this year.

Enhancement in UltimateTax Online 2022 … even more in 2023!

- E-Signature Notifications

- Client Letter Templates have many updates

- Easier completed print sets

- State-specific help

- Preparer Templates and Preparer selection on each return

The main benefits of having an online tax program are that updates are done for you, and you can operate anywhere. The system will update for you, so there is no manual process to ensure your system is updated. This removes an issue for the tax office, so they do not create returns on outdated software.

Access Your Software

Your software is available in your client portal – MyUltimateTax.com

You can find your income tax software, access invoices, renew your software, and many tools for training and support.

Purchase Tax Software

If you have not yet purchased your software for this season and you are currently not a customer of UltimateTax, you can get more information on our product pricing pages here.

Looking forward to a smooth, successful season!