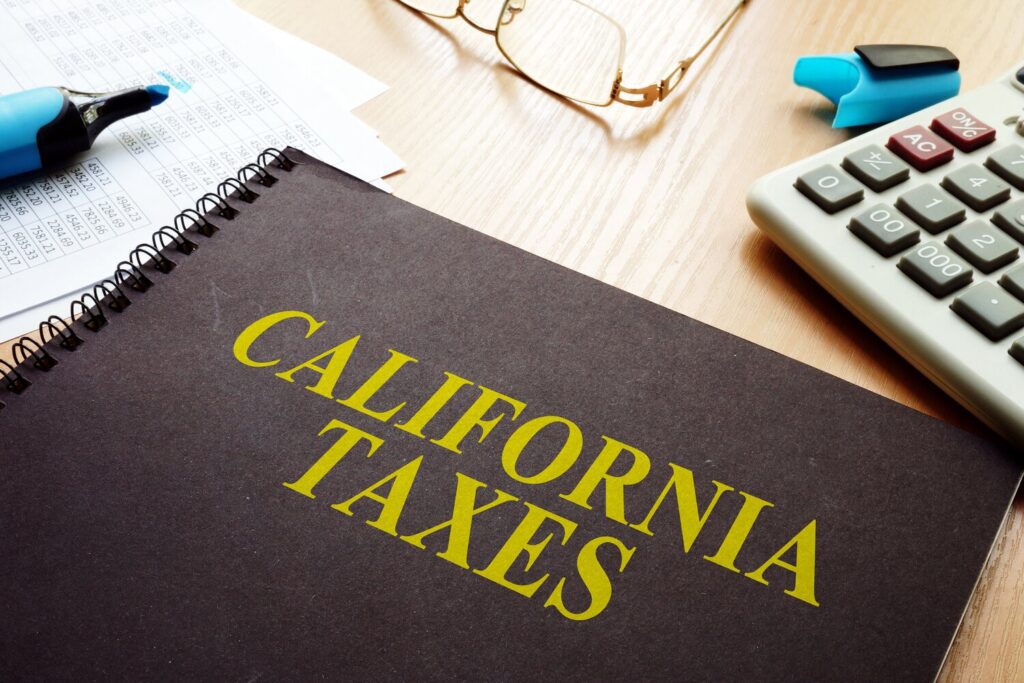

As the tax season approaches, the importance of knowledgeable and skilled tax preparers cannot be overstated. The state of California, which boasts the fifth-largest economy in the world, has a unique tax code that can be intimidating for even the most experienced tax professionals.

With the growing complexity of tax laws and regulations, demand for competent tax preparers is steadily increasing across the state. In this article, we will discuss the requirements and steps involved in becoming a tax preparer in California.

By exploring the necessary qualifications, education, and registration, aspiring tax preparers can gain a clear understanding of the pathway to a successful career in the lucrative field of tax preparation.

Understanding the Role of a Tax Preparer

A tax preparer is a professional who specializes in preparing tax returns for individuals and businesses. They work with a wide range of clients, including self-employed individuals, small business owners, and large corporations. Tax preparers are responsible for completing all necessary tax forms, ensuring clients comply with tax laws and regulations, and minimizing tax liability.

Many people often confuse tax preparers with other tax professionals, such as Certified Public Accountants (CPAs) and Enrolled Agents (EAs). The main difference between a tax preparer and a CPA is that a CPA is licensed to provide a broader range of financial services, including tax planning and auditing. EAs, on the other hand, are tax professionals who specialize in tax law and are authorized by the IRS to represent clients before the agency.

Becoming a tax preparer can offer many benefits, including the flexibility to work from home or as a freelancer, a wide range of job opportunities, and the potential to earn a good salary. Tax preparers may work for large accounting firms, small tax preparation businesses, or personal tax preparation businesses.

In addition, many tax preparers choose to become certified through organizations such as the National Association of Tax Professionals (NATP) or the National Society of Accountants (NSA) to increase their credibility and marketability to clients.

Overall, a career as a tax preparer can be both rewarding and financially lucrative for those who have an interest in accounting and a passion for assisting others with their tax needs.

Legal Requirements and Qualifications

When it comes to legal requirements and qualifications, it’s important to understand the guidelines set forth for various professions and industries. These requirements are put in place to ensure that individuals are properly qualified and trained to perform certain tasks, and to protect the safety and well-being of the public.

From licensing and certification to educational requirements and ongoing training, this section will explore the various legal requirements and qualifications that are necessary for different professions and industries.

California Tax Education Council (CTEC)

The California Tax Education Council (CTEC) is an independent organization established in 1997 to regulate the tax preparation industry in California. It requires all paid tax preparers to register with them and complete a minimum of 20 hours of annual continuing education courses to ensure they maintain a level of competency and stay up to date with changes in tax laws.

Registration with CTEC requires several steps, including the submission of an application, fingerprinting, and a background check. Additionally, all tax preparers in California are required to obtain a surety bond of at least $5,000, which will protect taxpayers in case of errors or fraud committed by the preparer. The registration fee for CTEC is $33, and the bond fee is determined by the amount of coverage required based on the number of tax returns prepared in the previous year.

CTEC enforces disciplinary action on unregistered or non-compliant tax preparers, including revocation of registration and imposition of civil penalties. In summary, CTEC plays a vital role in ensuring that taxpayers’ interests are protected and that tax preparers in California uphold professional standards.

Education and Training

Becoming a tax preparer requires meeting specific education requirements. In California, one of the prerequisites to become a registered tax preparer is completing a 60-hour qualifying education course. This course covers tax laws and regulations, tax preparation techniques, and ethics related to tax preparation.

It is essential to choose a course offered by an approved provider to ensure its credibility and that the material covers all relevant tax-related information. The CTEC approved several education providers that offer qualifying courses. Some of the approved providers include H&R Block, Jackson Hewitt, and Liberty Tax Services.

Once qualified, a tax preparer must maintain their registration with CTEC by completing a 20-hour continuing education course annually. This ensures that the registered tax preparer is up-to-date with changes in tax laws and regulations, updating their knowledge and skills to secure their status annually, and provide reliable services.

Obtaining a Preparer Tax Identification Number (PTIN)

A Preparer Tax Identification Number (PTIN) is a unique identifier issued by the Internal Revenue Service (IRS) to tax preparers. It is necessary for tax preparers to obtain a PTIN to comply with the IRS regulations, as it ensures that the tax preparer is recognized and authorized by the IRS to prepare and file tax returns for clients. The PTIN system helps the IRS to regulate tax preparation practices and maintain the integrity of the tax system.

To obtain a PTIN from the IRS, tax preparers need to complete an online application process available on the IRS website. The applicant has to provide personal information such as name, social security number, date of birth, and contact information, along with details of their tax preparation business. Additionally, the IRS requires preparers to disclose any felony convictions, tax-related convictions or license revocations, suspensions, and disbarments.

Upon successful completion of the application, the applicant will receive their PTIN via email, and it is valid for one year.

In most cases, getting a PTIN is a straightforward process, but tax preparers are encouraged to follow the IRS guidelines to avoid any delays or complications with their application. Preparers must also be aware of the renewal procedures to keep their PTIN current by renewing their registration annually. Failure to obtain or renew a PTIN can result in penalties, fees, or other disciplinary actions by the IRS.

Therefore, every tax preparer needs to hold a valid PTIN if they wish to conduct business legally and maintain a good reputation in their profession.

Steps to Becoming a Tax Preparer in California

Becoming a tax preparer in California requires a series of steps that must be followed meticulously for success. First and foremost, you need to complete the 60-hour qualifying

The California Tax Education Council must approve the education course.

This course covers various topics related to tax preparation, such as ethics, tax law, and accounting principles. After completing the education course, you need to obtain your PTIN from the IRS to prepare tax returns for clients legally.

Next, you are required to register with CTEC and purchase the required bond, which protects your clients in case of any negligence on your part. Additionally, you must meet annual continuing education requirements, which include completing 20 hours of tax law updates and ethics courses.

Finally, you need to build a robust client base through effective marketing strategies. You can use digital marketing tactics, such as social media marketing and email marketing strategies, to reach out to clients and build your reputation in the industry. By following these steps carefully and knowing the answers to common questions, you can become a successful tax preparer in California.

Tips for Success as a Tax Preparer in California

If you want to succeed as a tax preparer in California or any other state, follow these tips to stay ahead of the competition:

- Stay up-to-date with the latest tax laws and regulations. The tax code is constantly changing, so it’s important to keep current with new rules and procedures to avoid mistakes and provide accurate advice to clients.

- Join professional organizations and attend industry events to network with other tax professionals. Keeping in touch with your peers can help you stay informed of new trends, gather feedback and insights, and build relationships that can lead to referral business.

- Leverage social media to build your brand and reach potential clients. Develop a strong online presence through platforms like Twitter, Facebook, and LinkedIn, and use targeted advertising to attract new customers.

- Provide excellent customer service to retain existing clients and generate referrals. Create a welcoming atmosphere and be responsive to client inquiries and concerns. Go the extra mile to exceed their expectations and address their needs.

- Seek ongoing education and specialize in certain areas of taxation to increase your competitiveness in the job market. Earn certifications, such as the Enrolled Agent credential, to demonstrate your expertise and commitment to the profession. Focus on areas like small business taxes, estate planning, or international taxation to differentiate yourself from other tax preparers.

Explore UltimateTax Solutions for Your Tax Preparer Career

UltimateTax is the best solution for tax preparers who want to streamline their operations, save time, and maximize profits. This comprehensive tax software simplifies the tax preparation process with an intuitive user interface and numerous advanced features, such as diagnostic tools, e-filing capabilities, bank product integrations, and mobile accessibility.

By partnering with UltimateTax, you can enjoy several benefits that can take your tax preparer career to the next level. You will also get to enjoy flexible pricing options that cater to your unique business needs, whether you’re a startup or an established firm.

To kickstart your journey with us, contact us today!